FY23-24 Investment Overview

Our Approach

We take seriously our responsibility to serve as good stewards of donors’ charitable assets, as well as our responsibility to serve the beneficiaries of those assets.

Investment Overview

Using a model created by the South Dakota Investment Council, the Foundation’s Investment Management Committee helps guide the asset allocation within the Long-Term Portfolio.

Fiscal Year in Review

Domestic equity markets showed significant resilience despite the economic uncertainties of fiscal year 2024. Continuing on the heels of a strong start to 2024, the S&P 500 closed at all-time highs on many occasions over the year. For the 12-month period ending June 30, 2024, it posted an impressive return of more than 24%, primarily driven by a strong tech sector. International markets experienced more headwinds but showed positive returns overall.

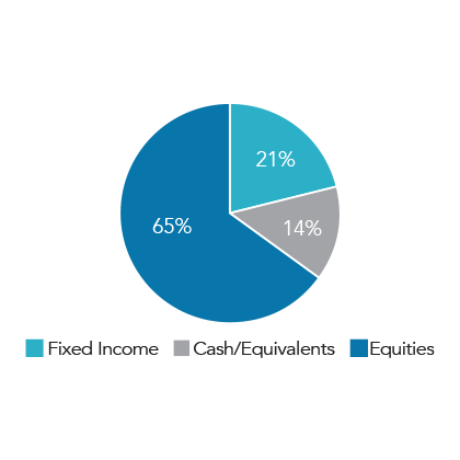

The Foundation’s Long-Term Portfolio did not adjust its tactical target at any point during the fiscal year. The equity allocation of 65% caused the portfolio to fall behind its benchmarks with higher equity allocations. The portfolio, which favored international investments over domestic, is incrementally shifting toward domestic equities to align with global indices. Allocations to Chinese markets have also decreased. Due to a continued period of high interest rates, the portfolio was advantaged by its 14% cash position.

Looking ahead, the Investment Management Committee will continue to inform decisions based on the model, employ a disciplined management strategy, and focus on long-term results. As markets allow, the committee will look for strategic opportunities while monitoring inflation, interest and other economic indicators.

The Foundation’s Long-Term Portfolio did not adjust its tactical target at any point during the fiscal year. The equity allocation of 65% caused the portfolio to fall behind its benchmarks with higher equity allocations. The portfolio, which favored international investments over domestic, is incrementally shifting toward domestic equities to align with global indices. Allocations to Chinese markets have also decreased. Due to a continued period of high interest rates, the portfolio was advantaged by its 14% cash position.

Looking ahead, the Investment Management Committee will continue to inform decisions based on the model, employ a disciplined management strategy, and focus on long-term results. As markets allow, the committee will look for strategic opportunities while monitoring inflation, interest and other economic indicators.

Long-Term Portfolio Overview

Current Portfolio Allocation

Tactical targets by asset class as of June 30, 2024.

Compound Annualized Returns

Long-term portfolio returns as of June 30, 2024.

Our Investment Management Committee

We're grateful to the following individuals who volunteer their time and expertise as current members of our Investment Management Committee:

- Angeline Lavin (Chair), SFACF board member

- Todd Ernst, SFACF board member

- Suzanne Veenis, SFACF board member

- Ben Wiener, SFACF board member

- Scott Van Horssen, Financial professional

- Jarrod Edelen, Financial professional