Latest News

Support Your Favorite Charities and Enjoy Tax Benefits through a Donor Advised Fund

For many, last week represented one of the most difficult days of the year: April 15 — tax day.

If you’re still feeling the effects of your 2018 tax return, the Sioux Falls Area Community Foundation’s Mary Kolsrud, vice president, philanthropy, has some tips for how to improve your 2019 tax deduction potential while doing good for your community at the same time.

Q. Thanks to some major tax law changes, many have said they feel like they missed out on important tax benefits for charitable deductions this year. Can you talk about the 2017 Tax Cuts and Jobs Act and its impact on taxpayers?

Kolsrud: In a nutshell, the 2017 Tax Cuts and Jobs Act doubled the standard deduction for a married couple filing jointly. The new standard deduction is $24,000 (up from approximately $12,000). The change also capped state and local tax deductions at $10,000.

Together, these changes pushed many people to take the standard deduction, rather than itemizing their deductions — including their charitable donations — as they did in the past. In doing so, their 2018 charitable giving tax benefit was essentially eliminated.

Q. How can taxpayers plan accordingly so the same thing doesn’t happen next year?

Kolsrud: A donor advised fund is a great tool to consider for taxpayers who want to continue receiving tax benefits for their charitable giving.

A donor advised fund is essentially an account designed to help you support the charities and causes you’re passionate about. As a fund advisor, you can choose when you want to recommend distributions from the fund to nonprofits you care about.

Many of our donors have told us the most valuable feature of a donor advised fund is the fact they can claim a deduction in the year they donate to the fund. For example, if I make a donation to a donor advised fund in 2019, I’ll see the tax deduction for that donation in 2019, even though I may recommend charitable distributions from that fund for the next two years, five years or beyond. This strategy is called ‘bunching.’

Q. “Bunching” is quickly becoming a buzz word — what can you tell us about it?

Kolsrud: ‘Bunching’ lets a donor group several years’ worth of charitable donations into one contribution, pushing their itemized deductions above the new higher standard deduction amount for that year. Then, over subsequent years, standard deductions can be taken.

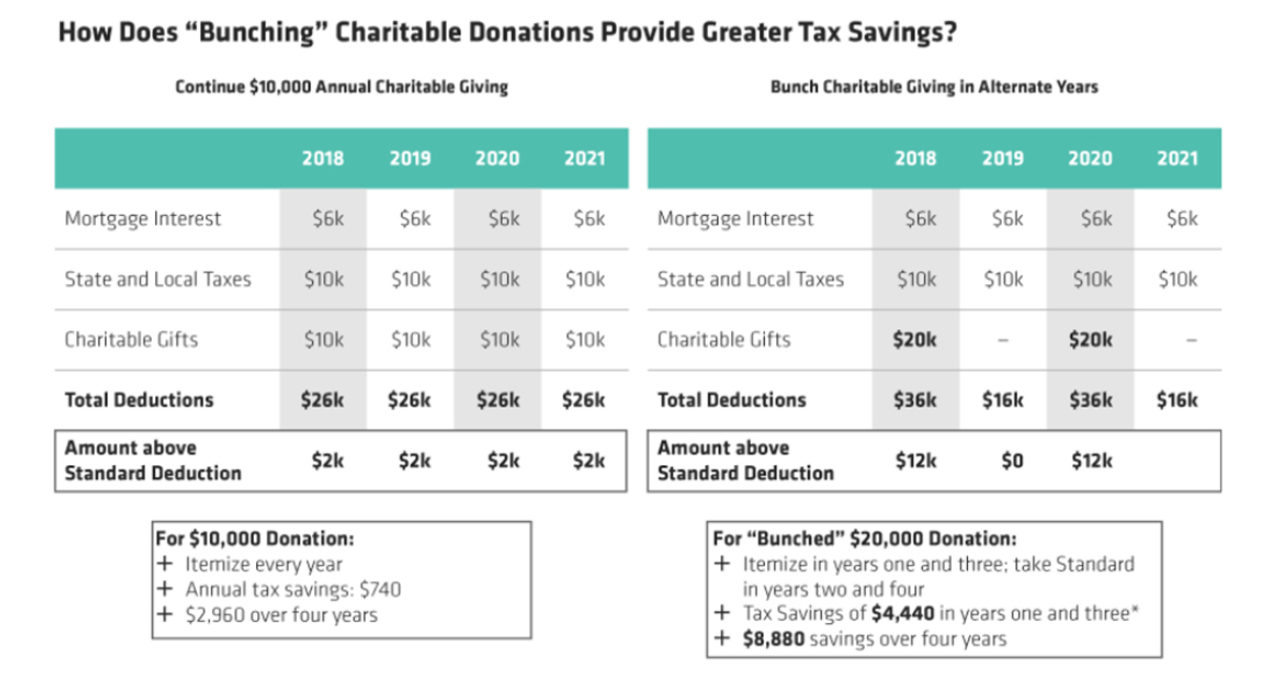

This chart from Alliance Bernstein, a global investment-management and research firm, provides a great example based on a married couple who file jointly and who typically donate $10,000 to charity every year. You can see how ‘bunching’ in years 2018 and 2020 dramatically impacts their tax savings:

Q. How do I know if a donor advised fund and “bunching” are right for me?

Kolsrud: At its most basic level, a donor advised fund is a tool that helps you do good for your community by enabling you to make distributions to nonprofits while creating maximum tax advantages.

The donors we work with value their donor advised fund because it allows them the option to donate cash as well as appreciated assets, such as stock and securities. Donating appreciated stock allows you to receive an income tax deduction and avoid capital gains taxes.

As far as ‘bunching’ goes, we generally say it’s a strategy that makes a lot of sense if you or your family make annual gifts to charities and can afford to group or ‘bunch’ several years’ worth of your giving at one time.

Whether it’s thinking about a donor advised fund, or a strategy like ‘bunching,’ when it comes to charitable and tax planning, the best thing you can do is talk with your tax planner or financial advisor.

Q. Why choose a donor advised fund through the Community Foundation?

Kolsrud: Donors often say they chose the Community Foundation because we offer technical expertise from a philanthropic planning standpoint — we hold more than 1,000 funds at more than $168 million in assets — and because our Community Investment arm has a pulse on the needs and opportunities within our community. Together, we connect donors with causes to drive meaningful change through philanthropy.