Latest News

Recent Sale of Raven Industries Is a Good Reminder Why Donating Appreciated Stocks Makes Great Sense

At some point throughout your life, you’ll likely find yourself facing a taxable event. Maybe you’re selling your business. Maybe you’ve inherited property. Or, maybe you own stock in a business like Raven Industries that’s recently increased in value.

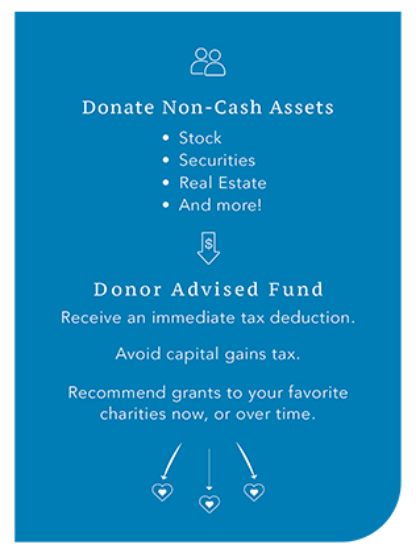

Did you know you can dramatically reduce your taxation from these events by donating those non-cash assets to a donor advised fund at the Community Foundation?

Donating appreciated assets such as stocks and securities has always been a tax-wise philanthropic strategy. This method not only allows a donor to avoid capital gains tax, it also provides an immediate deduction for the fair market value of the asset. What’s more, it gives donors time to thoughtfully consider where and how to apply their charitable gifts for the greatest impact.

While donating appreciated stocks and securities has always been popular, with new proposed tax law changes on the horizon, we are predicting an even greater surge in the number of donors who choose to use non-cash assets to fund their philanthropy.

Preliminary proposals and several bills recently introduced in Congress may provide an even greater incentive for gifts of appreciated assets. Currently, high-income earners pay a 20% capital gains tax when selling assets held for longer than one year. Under one proposal, those who earn more than $1 million could see a 39.6% capital gains tax rate, with the tax hike retroactive to the date of announcement. Of course, the tax change is still under negotiation and it’s tough to predict whether the retroactive capital gains tax increase will survive negotiations in Congress.

Whatever changes may happen, there’s simply never been a better time to make a gift of appreciated stock or securities to support the charities that matter most to you. And again, it’s important to remember: Donors who make outright gifts of appreciated assets essentially receive a double benefit: you’ll eliminate capital gains tax and you’ll receive an immediate deduction of the fair market value of your asset.

Want to learn more? We’re here to help! Contact us at 605.336.7055.

This article is provided for informational purposes only. It is not intended as legal, accounting, tax or financial planning advice. Always check with your tax advisor before making any charitable gift.

Related Posts

Investing in Tomorrow's Leaders

“We’ve long believed that philanthropy and education can and must intersect to help drive positive change." Meet two of our 2021 Community Foundation scholars and learn how they hope to use their education to impact positive change throughout our community.

Read More